What’s New in 18.5.0

Mobile updates

Updates to Base (free)

- Available Equity in Refinance Analyzer

Instantly see how much equity is available while adding debts to consolidate, making refinance conversations clearer and faster. - More Admin Colour Themes

More colour options are now available to better match your branding. - Cleaner Experience for Interest-Only Mortgages

Irrelevant fields are now hidden, keeping the experience clean and focused.

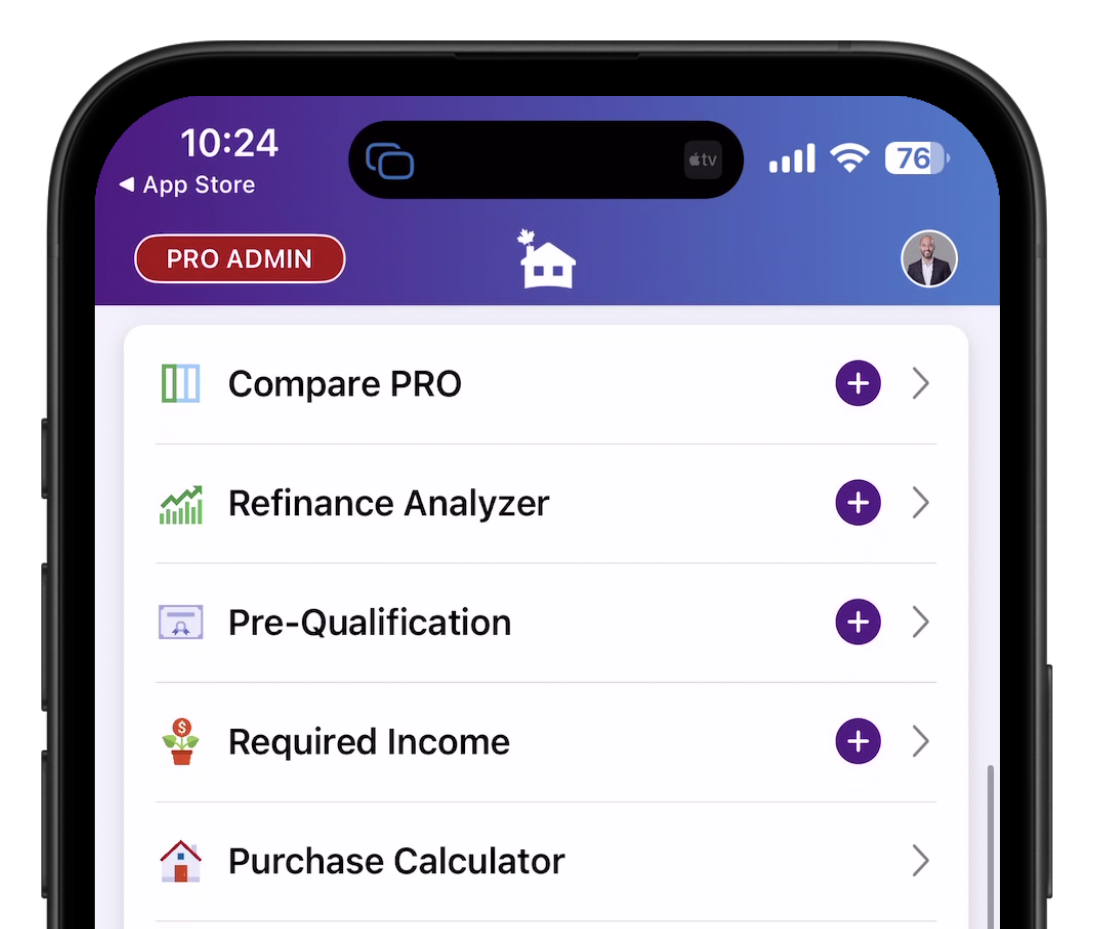

Updates to PRO (paid subscription)

- Prime Projection Map for Variable Rates in the Refinance Analyzer

Model real-world variable-rate refinances using projected changes to prime rates and analyze potential long-term savings. - Compare PRO now includes support for Cashback & Rental Income

Analyze renewal scenarios with lender cashback incentives to better explain real-world offers. Compare purchase scenarios using rental income to more accurately determine the total monthly cost. Additionally, you can review and import your clients' comparison scenarios directly into your analysis. - Lead Journey CRM Integrations

New integration options help you connect leads with your favourite CRM and POS systems. - Co-Branded Lead Journeys

Generate co-branded journey links you can share with referral partners for a more polished, collaborative experience. - PRO Desktop Tools

We have developed three new desktop tools that are accessible in your web admin dashboard. To log in to your web admin dashboard, open your mobile app, go to "Settings," then "Web Login."

Version 18.4.0

Compare (PRO)

- You can now break the mortgage immediately at 0 months in Compare PRO.

- Added new graphs that show total interest, total principal, and total paid to help you understand the full cost of your mortgage.

- Fixed an issue that caused a crash when opening the Full-edit screen

Generate Update

- Added a universal “Start New” button across all tools for faster scenario creation.

Pre-Qualification (PRO)

- Updated the Personal Debt section in Pre-Qual to support multiple payment frequencies.

Thank you for using CMA. If you are an industry professional and have questions or want to learn how to leverage CMA PRO for your business, reach out to us through the support chat under the Settings tab.

• The Bendigi Team •

Version 18.3.1

Compare PRO Renewal – Levelled Up (Again)!

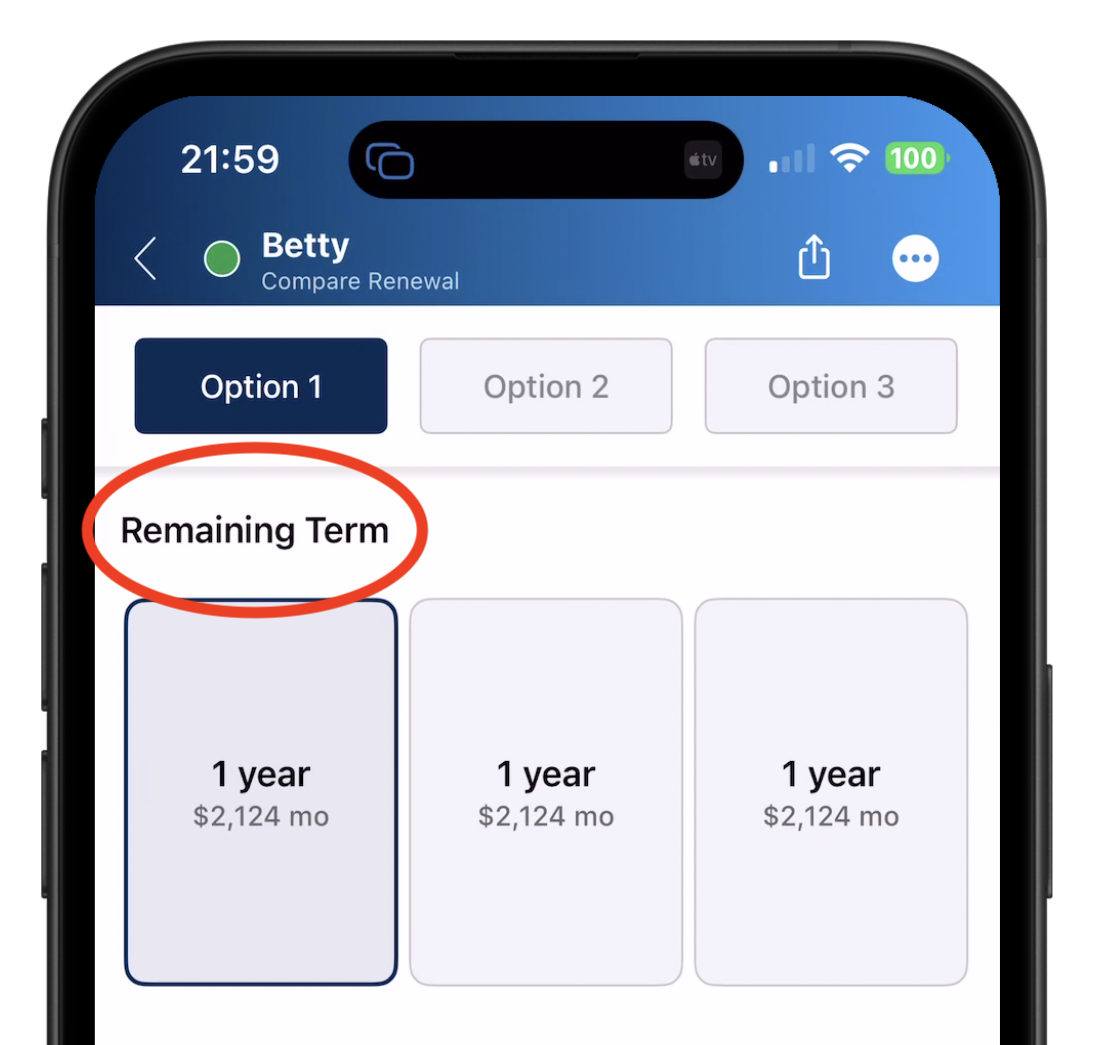

Now includes advanced options like:

- Breaking before the end of the term

- Extending amortization

- Taking out equity

Try it out by creating a new scenario in Compare PRO (side-by-side) and tapping “Remaining Term”

More accurate Quebec estimates

- We’ve added support for five new regions to calculate the Taxe de Bienvenue better.

Fixes & improvements

- "Start Application" no longer appears for non-consumers in Refi Analyzer.

- Editing your Current Situation now updates correctly via the full edit screen.

- Fixed a glitch where payment amounts reset after changing frequency in Compare Renewal onboarding.

- The "Start New" button now works properly on all tools.

- Added a new Extra Payment indicator in Compare PRO.

- Squashed several bugs in the Mortgage Journey Map.

- Refreshed French translations for RVP and ABD/ATD.

Version 18.2.3

This version improves the Refinance Analyzer's time-saving algorithm when your current mortgage is on an accelerated payment frequency.

Version 18.2.0

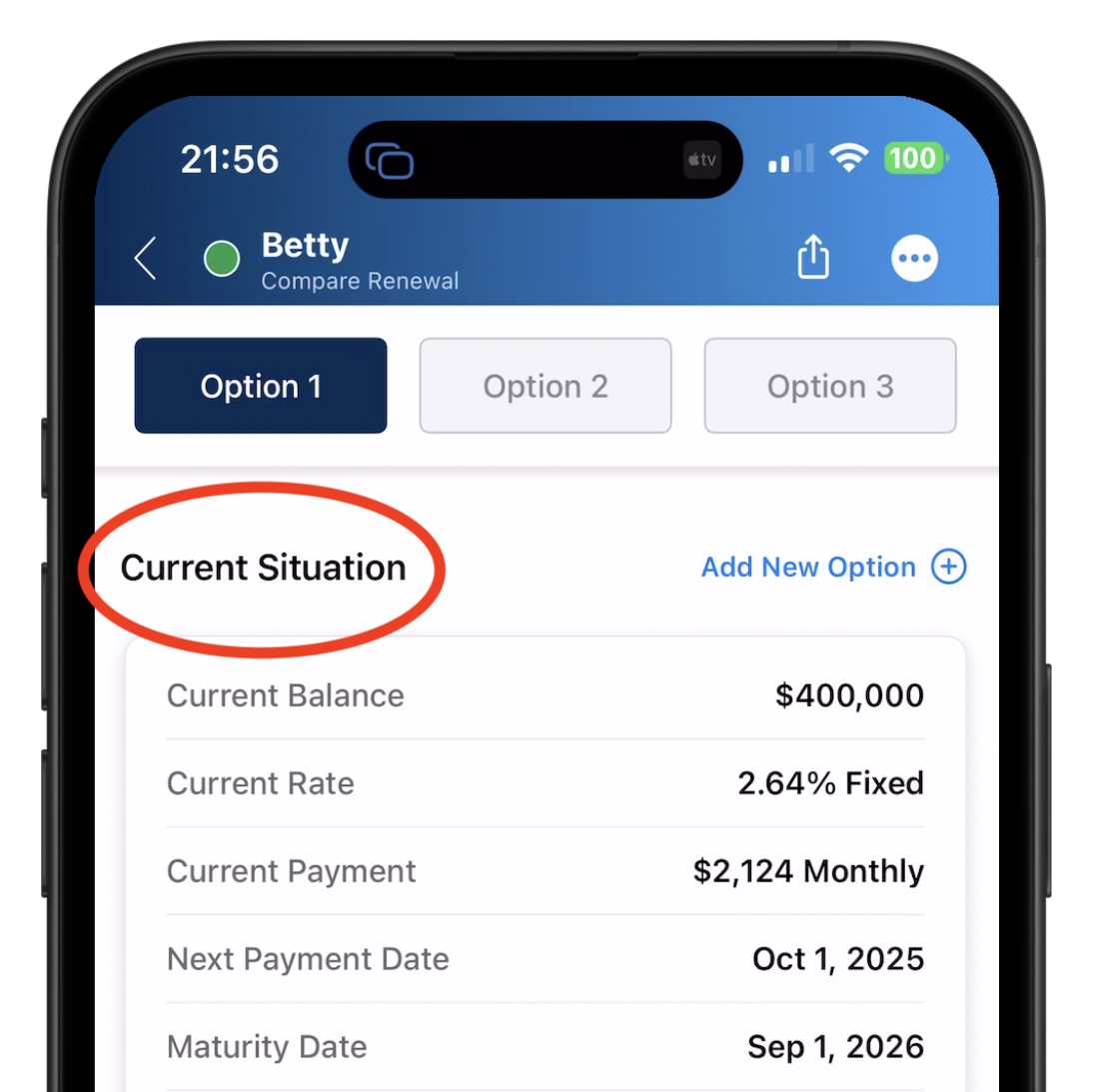

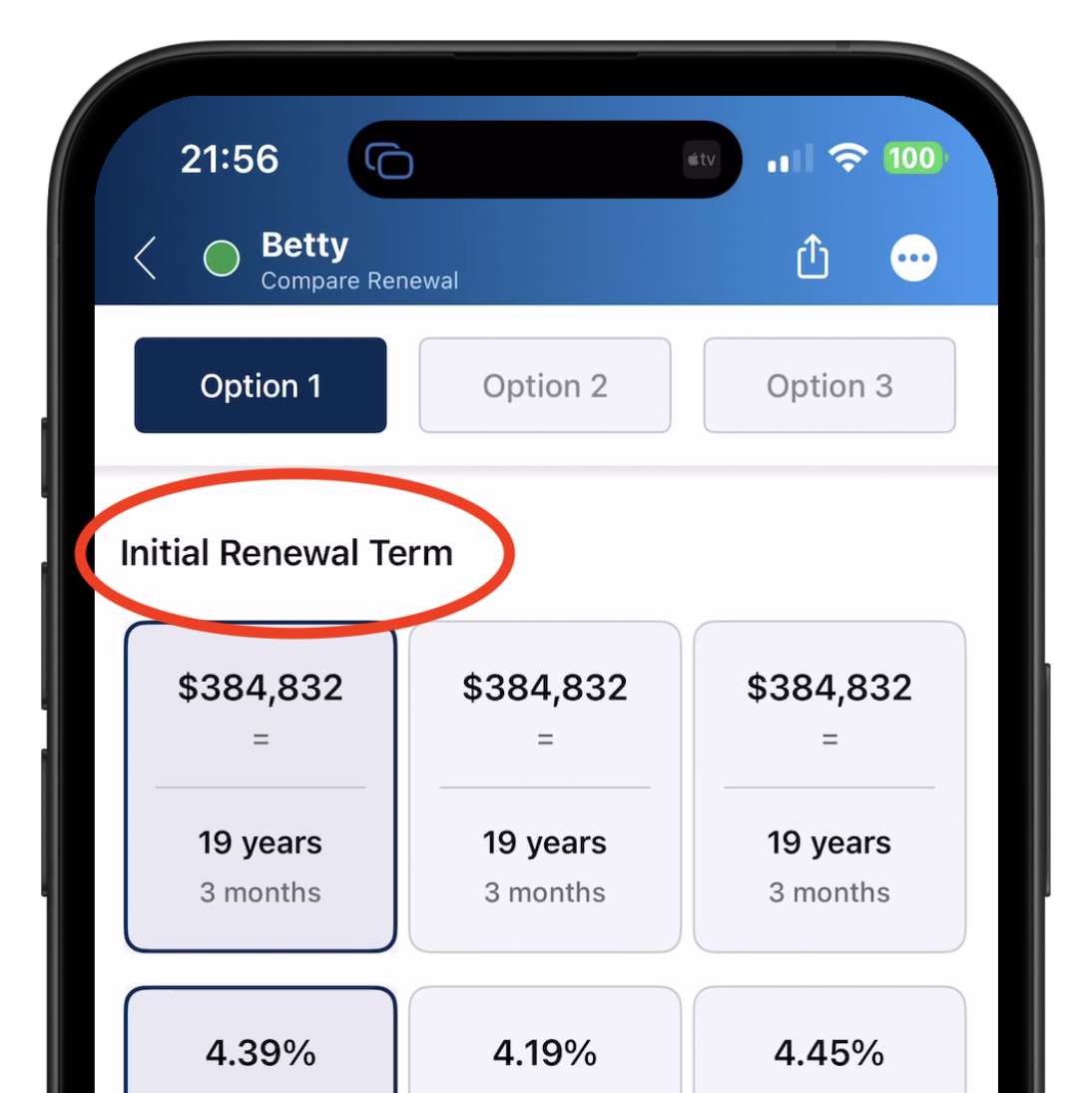

Compare PRO Renewal has been thoughtfully redesigned from the ground up.

We’ve worked hard to make the experience more intuitive, so you can now explore renewal scenarios with greater ease and clarity..

Starting with your current situation, you’ll be able to review your current mortgage and options for the remaining term, including breaking early, changing payment frequencies, applying extra payments, and even modelling prime rate changes (for variable mortgages).

Each adjustment automatically recalculates the balance and amortization, so results stay accurate through to the renewal date.

You can also create multiple renewal terms, compare different rates, and layer in other actions just as before, but now with a smoother side-by-side comparison that makes decisions easier.

We’re proud to say that Compare PRO Renewal is the most complete mortgage comparison tool we’ve ever built, and we hope it makes your mortgage or your client conversations more insightful, transparent, and impactful.

Version 18.1.2

- Updates to the Lender Rental Sheet for some lenders

- Improved Scenario loading

Version 18.1.1

- Fixed a bug when duplicating a scenario

- Fixed a bug when deleting a recently duplicated scenario

Version 18.1

Compact View

- New Home Screen Compact View. Try it out in the Home Screen. Swipe to the bottom and use "Edit Dashboard" to set the view mode to "Compact."

Compare PRO

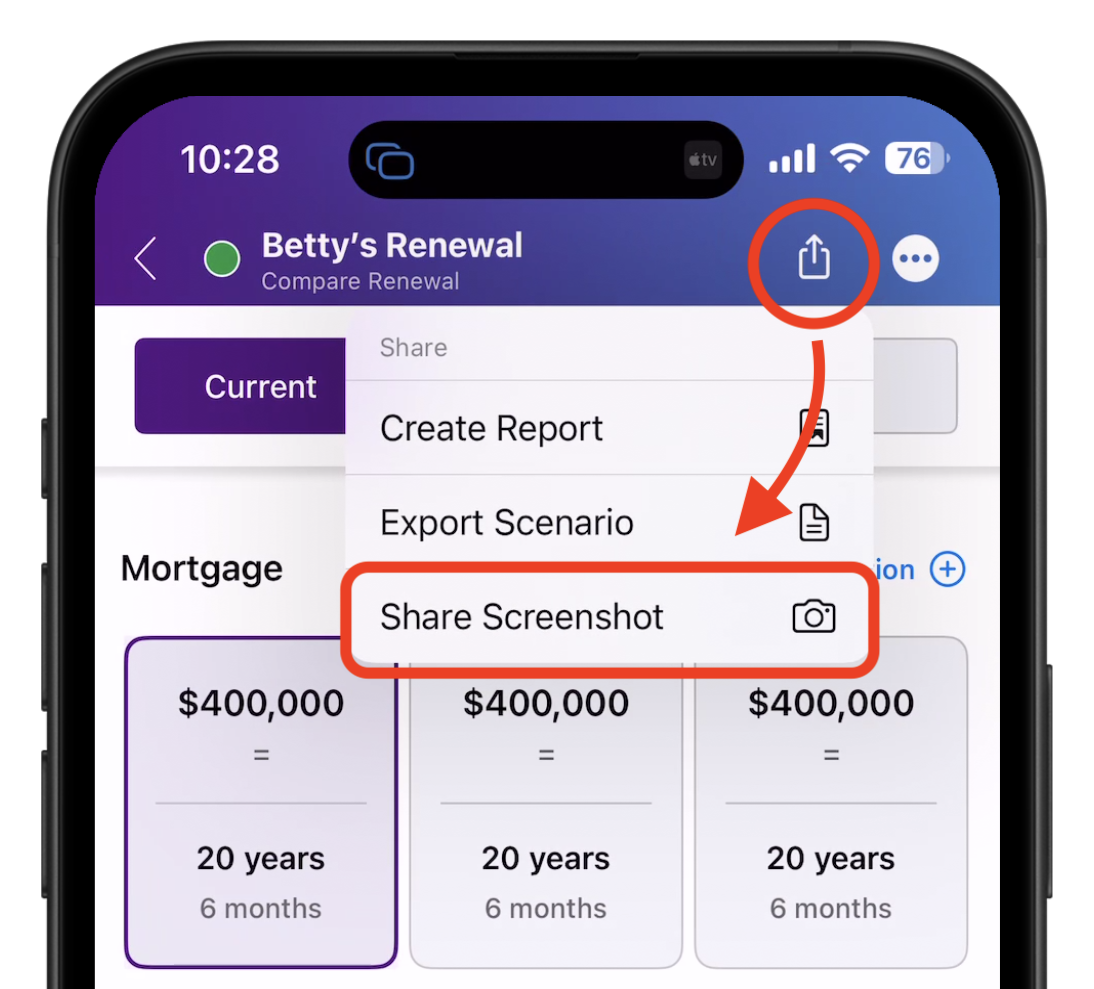

- New Screenshot feature in Compare PRO. This feature gives you a comprehensive screenshot in the Compare PRO tool. Visit Analysis, Table tab, and check out the screenshot button.

Pre-Qualification Tool

- Desjardins and CIBC Rental Sheets in PREQ PRO. This will let you view the purchase power of these two lenders when working with non-subject properties.

Refinance Analyzer

- Estimate 3-month Penalty in Refi Express. Quickly estimate the penalty during the Refinance flow.

Core App Improvements

- Improved Login flow. It's now more intuitive, remembers your last login, and for Mortgage Brokers, lets you use your company's internal login service.

- 50+ fixes, enhancements, and improvements

Version 18

We’ve rolled out some exciting updates to boost performance, simplify workflows, and make the app even more powerful. Here's what’s new:

Scenario Management

- You can now load an existing scenario or create a new one before entering any tool.

- Scenario Grid has been moved into the Scenario List for better organization.

Pre-Qualification PRO

- Fixed a major bug affecting insured scenarios

- Added a debt reminder during onboarding if none are entered

- Added a payment field for personal loan debts for better accuracy

- New "Create Report" button added directly to the Scenario List

- "Send to Webhook" option available for faster sharing

- Rental lender sheets now execute in parallel, up to 50% faster

Refinance Analyzer

- Introduced an express setup flow for power users

- Added a new "Estimate 3-Month Penalty" button in the wizard

- Fixed the accelerated bi-weekly payment calculation bug

- Optimized lender list performance with caching

Compare PRO

- Brand new design for selecting rate type and term - easier and more intuitive

- No more term restrictions in the break-even rate screen

- Fixed bug with the "Apply All" button in the wizard

Stress Test Calculator

- Added a GDS/TDS ratio slider to test different thresholds and find your target mortgage quickly

Required Income Tool

- Fixed an issue preventing MQR from updating after Rate selection

MacOS Enhancements

- Improved appearance and experience on macOS

- Fixed a crash when opening Settings in Light Mode

- Corrected all colours on the dashboard and tool cells

Core App Improvements

- You can now "Continue as Guest" when accessing tools that require an account.

- Intro pages added to all tools with auto-scroll for guided onboarding

- Added main tab bar across all tools for easier navigation

- Updated all animation libraries - enjoy smoother transitions throughout the app

- Cleaned up app install links by automatically removing invalid characters

- Increased padding on dashboard overlays for better readability

Thanks for choosing the Canadian Mortgage App. This update is all about speed, clarity, and giving you more control so you can focus on what matters most.